COVID-19 may have frozen the real estate market earlier this year, but it thawed in a spectacular fashion in July with 62,355 sales nationally. Amidst all the negative COVID news, this was a breath of fresh air for everyone. Resilient Canadians reshaped their demands for housing and pushed prices higher than any other month in the past 40 years.

COVID-19 may have frozen the real estate market earlier this year, but it thawed in a spectacular fashion in July with 62,355 sales nationally. Amidst all the negative COVID news, this was a breath of fresh air for everyone. Resilient Canadians reshaped their demands for housing and pushed prices higher than any other month in the past 40 years.

The Highs and Lows Contributing to this Climate

- Home sales were bolstered by all-time low mortgage rates – less than 2% on a 5 year fixed rate mortgage

- The Bank of Canada reduced the benchmark qualifying rate (stress test rate) to 4.79% (from 4.94%)

- Staying at home and working from home meant:

- pressing pause on the daily commute

- having more freedom to work at different times

- discovering a new-found importance of home

- realizing the desire for more space indoors (a home office for you and play area for the kids) and out (pools and patios)

Mortgage Forecast for Fall

I’m predicting a bright and sunny fall with buyers continuing to show confidence by keeping the real estate market active as they satisfy their pent up demands. It’s also expected Canadian mortgage rates will stay below 2% for quite some time.

Are you ready to make your move?

When you or someone you know needs personal mortgage advice for current or future financing needs, connect with me to schedule a confidential and no cost or obligation mortgage financing consultation. I’ve been providing mortgage solutions that open doors since 2005.

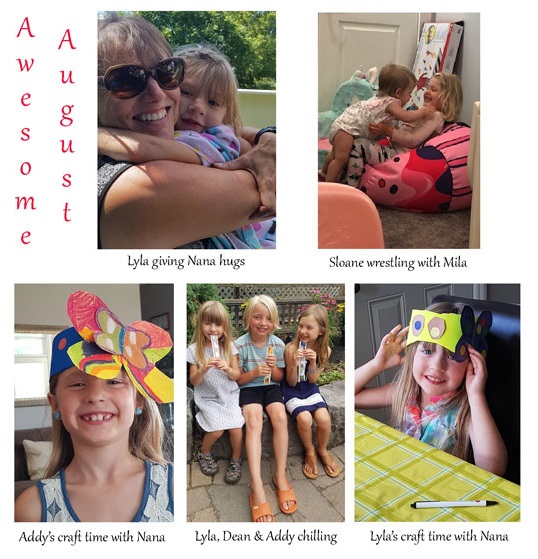

Amazing August

Cycling to Paris (Ontario)

Enjoying a long cycling adventure to Paris with my friend, Margot.

Enjoying a long cycling adventure to Paris with my friend, Margot.

C’était magnifique

Full disclosure: I was glad the wind was at our backs coming home, I’d forgotten how long the ride is!