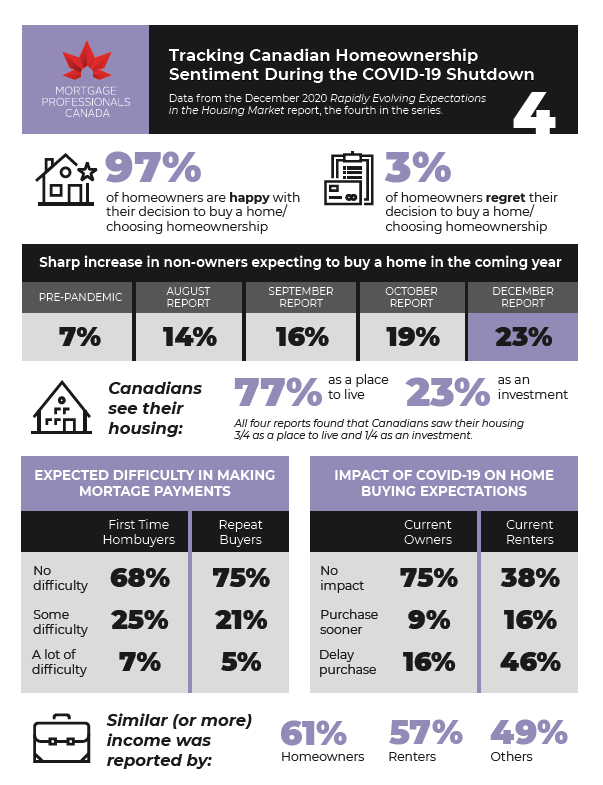

This we know for sure. For the second straight year despite the COVID pandemic (and all its variants), the Canadian real estate market has continued its upward climb.

The Canadian Real Estate Association predicts that when all the 2021 numbers are in, home sales and home prices will be 21% and 21.2% higher respectively.

The Canadian Real Estate Association predicts that when all the 2021 numbers are in, home sales and home prices will be 21% and 21.2% higher respectively.

CREA also reported that low inventories of homes for sale are expected to keep upward pressure on prices for much of 2022. “While price growth is not expected to be as extreme in 2022, many of the conditions that supported it right up until the end of 2021 will still be there on New Year’s Day,” CREA noted in its housing forecast.

Big 6 Bank Interest Rate Forecasts

(notice the changes in rates compared to my blog of November 9)

| Target Rate: Year-end ’21 |

Target Rate: Year-end ’22 |

Target Rate: Year-end ’23 |

5-Year BoC Bond Yield: Year-end ’21 |

5-Year BoC Bond Yield: Year-end ’22 |

|

| BMO | 0.25% | 1.25% | NA | 1.45% | 1.80% |

| CIBC | 0.25% | 1.00% | 1.75% | NA | NA |

| NBC | 0.25% | 1.50% | 1.75% | 1.40% | 1.90% |

| RBC | 0.25% | 1.00% | 1.75% | 1.25% | 1.65% |

| Scotiabank | 0.25% | 1.25% | 2.25% | 1.50% | 2.05% |

| TD Bank | 0.25% | 1.00% | 1.75% | 1.35% | 1.90% |

My Professional Advice Regarding Buying a Home and Mortgage Lending:

- Don’t get caught up in the FOMO (the fear of missing out)! It may be in your best interest to wait until 2023 to buy. Let’s talk about what is the right decision for you!

- Make sure you have mortgage preapproval so when the right house and time comes along, you are ready to put in that offer with confidence!

- If you have an existing mortgage, you still have to qualify for your new mortgage if you purchase another home (regardless of whether you port your mortgage or not).

- If you are in the last year of your mortgage and purchase another home, you will have to break your current mortgage. It is a good idea to know the approximate penalty as it may influence your decision on whether to buy before or after your renewal.

- If you are going on maternity leave, your income will be adjusted to what you will earn while you are on leave. It may impact your income and qualifying mortgage amount.

- If you change jobs and are on probation, that may affect your ability to qualify for a mortgage.

- While interest rates are raising, it appears the government is very cautious about raising rates quickly. If your mortgage is renewing this year, some lenders allow an early renew option that would help you lock in at today’s rates. Let’s look at the options!

Remember, expert mortgage advice is available any time! Contact me, Tracy Irwin, Mortgage Broker to set up a time to talk! Feel free to share this information with family and friends… I am here and happy to help!

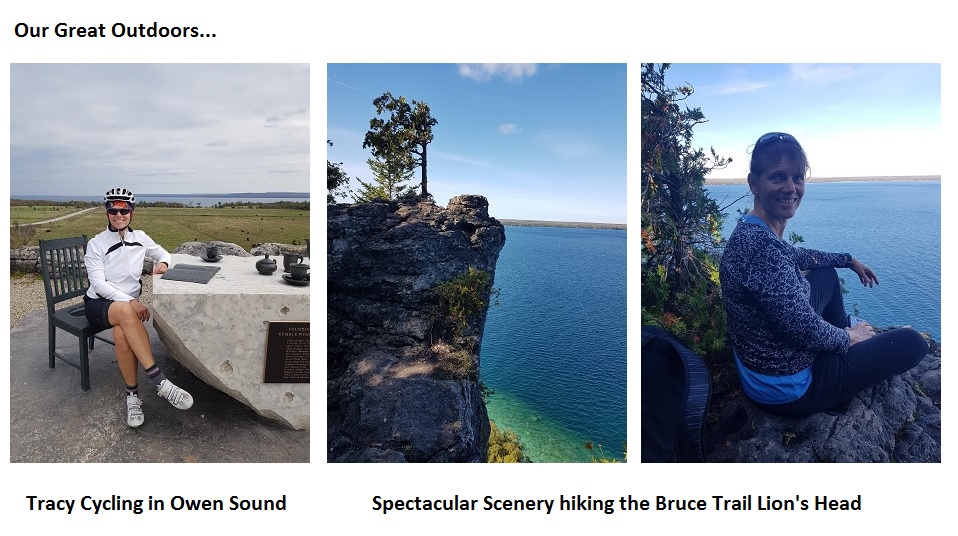

Cold Hands and Warm Hearts