Ah August… it’s a time to sit back, relax and get caught up on all the important mortgage news of the day, right?

Ah August… it’s a time to sit back, relax and get caught up on all the important mortgage news of the day, right?

August is also a month full of juxtapositions.

Some of us are taking time off and going away while others are heading back home. Many are enjoying warmer than normal summer temperatures (okay, ridiculously hot), at the same time they’re thinking about fall, and getting the kids back to school. Some couples are actively looking for new homes, while others have decided to stay in their present location.

In this month of contrasts, I decided to feature both the clear as mud and crystal clear mortgage financing news.

Clear as Mud…

Emerging Details on the First-Time Home Buyers Incentive

Details on the CMHC’s First-Time Home Buyers Incentive have been slow coming out since the down payment assistance program was first announced as part of the Liberal government’s 2019 budget (way back in March). Here’s a recap of what we now know:

- The $1.25 billion program is on track to begin September 2, 2019

- The program will provide 5% of a first-time buyer’s down payment for the purchase of existing homes, or 5% or 10% for the first-time buyer’s purchase of a new build

- A participant’s insured mortgage and the incentive amount cannot be greater than four times the participant’s qualified annual income

You can learn more here: https://www.placetocallhome.ca/fthbi/first-time-homebuyer-incentive and/or sign up to receive additional details about the incentive when they become available (in the next 3 weeks?) on the Canada Mortgage and Housing Corporation website here:

https://www.cmhc-schl.gc.ca/en/nhs/canada-first-time-home-buyer-incentive

Crystal Clear…

Guess How Much of a Difference Prepayment Privileges Really Make…

If you pay your mortgage as a bi-weekly accelerated payment instead of monthly or semi-monthly, you will pay down your mortgage faster by almost 3 years!

Here’s a great way to “recycle” your money and pay less interest. Consider making an RSP contribution so that you will receive a tax credit and most likely a tax refund. You could then apply the tax refund to your mortgage using the “lump sum prepayment privileges”.

Any additional payments that you make against your mortgage will go directly towards principal and greatly reduce the amount of interest you pay over the life of the mortgage. Most lenders will allow you to pay as little as $100 on any mortgage payment throughout the year.

Another option is to increase your mortgage payment – set it and leave it. For a few extra dollars, the interest savings will be noticeable and will help you be mortgage-free sooner!

Either Way…

Whether you’re staying put in your current home or getting ready to make a move, talk to me today! Your questions are always welcomed!

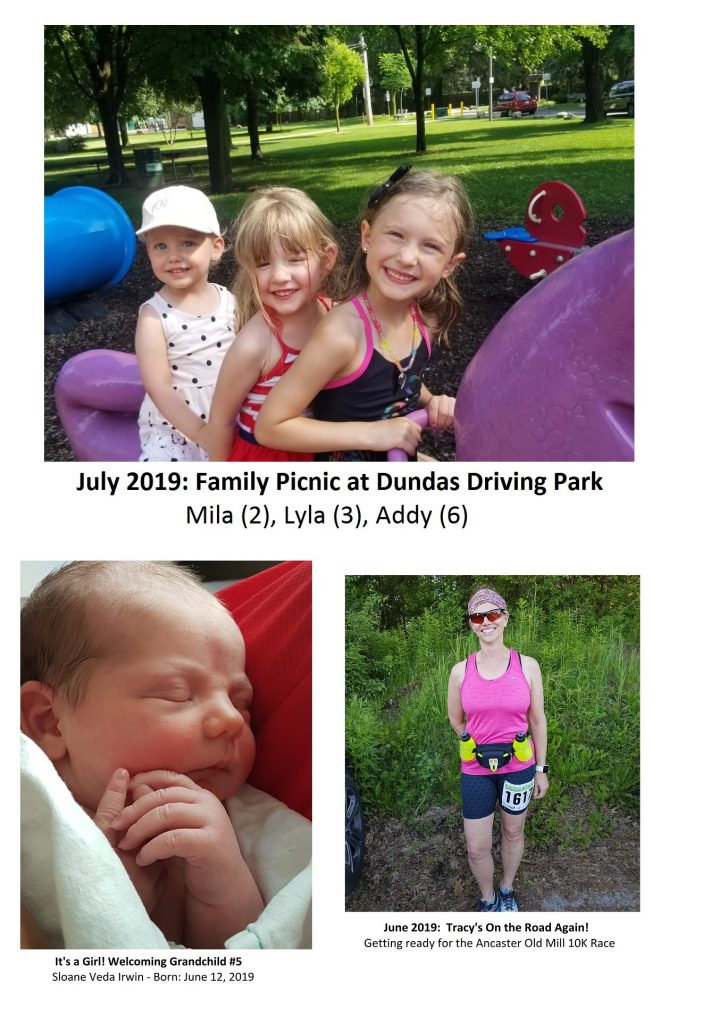

Tracy’s Sun-sational Summer News!

Summer is never a time to put on the brakes! Here’s how we raced through June and July.