Are they always the right choice?

Are they always the right choice?

Standard amortization on a mortgage in Canada is 25 years. But, if you have at least 20% home equity, most lenders will offer you 30, and a handful will offer you a 35 year amortization period.

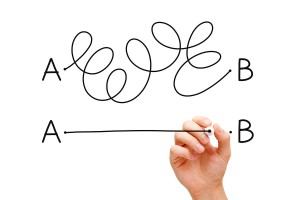

For years we’ve been taught that shorter mortgage amortizations are better. Most people in the mortgage business don’t challenge this concept. Until now.

Do longer mortgage repayment periods truly cost you more? In some cases – no. Longer amortizations, which spread your payments over 30 or 35 years instead of the traditional 25, can cost you significantly more in mortgage interest, but consider four scenarios where a longer period works your advantage.

Scenario One: You have other high interest debt

Longer amortization periods mean lower mortgage payments and that frees up cash flow that can be better used elsewhere. For instance, if your mortgage interest rate is 3% but you have credit card debt at 20%, it makes sense to pay the least amount possible on your mortgage and pay off the credit card debt.

Scenario Two: Your investments have higher yields

Even if you’re debt free, a longer amortization can still make sense. The trick is, you must earn an after-tax return on your investments that’s higher than your mortgage rate.

Scenario Three: You expect low long-term mortgage rates

One of the most important concepts in finance is the time value of money. It’s the idea that money in your hand today is worth more than the same amount of money in the future. That’s because you can invest money today to earn a return over time.

Scenario Four: You think inflation will rise long-term

The time value of money also comes into play here. The higher the rate of inflation, the less your money is worth in the future. The smaller the difference between your mortgage rate and the rate of inflation, the less sense it makes to pay off your mortgage quicker (and the greater the benefit of a longer amortization).

A word of caution

A longer amortization period mean you pay less principal with every regular payment. In turn, you’ll have a bigger balance every time you renew the mortgage. After 10 years, for example, a $200,000 mortgage at 3% interest would leave you a balance of $137,235 (25-year amortization) or $162,205 (35-year amortization). If today’s historically low rates rise by the time you renew, a longer amortization period means you’ll pay more interest on a bigger balance. This means your other investments need to offset this in order for you to be successful with this strategy.

The free option

It goes without saying, shorter amortizations force homeowners to save more, which helps the less disciplined. But, if you’re a well-qualified borrower, have a savings mentality and are eligible for a longer amortization, a 30 to 35 year amortization period is one of the best free options you can get.

One final point (and it’s a good one)

Remember that even with an extended amortization period, you can easily make optional extra payments to replicate a shorter amortization. You can even automate those extra payments. Then, if an investment opportunity arises or you need extra cash for personal reasons, simply reduce your mortgage payments back to the minimum and divert the cash flow to a better use. For the right borrower in the right circumstances, longer mortgage repayment periods can be a sound strategy.

Looking for more mortgage strategies related to refinancing/debt consolidated? Talk to Tracy Irwin today!