How far would you go to help your children?

How far would you go to help your children?

As parents, we all want to help our children succeed in life. But, would you be willing to go to the extreme of setting up a reverse mortgage on your own home so your children can become homeowners themselves?

“As an increasing number of parents help their children attain homeownership, reverse mortgages are being touted as a way to do just that but with fewer encumbrances.” Read it and weep…

Tracy’s Point of View: Pitfalls of a Reverse Mortgage

While reverse mortgages may be a good fit for some people, there are (at least) 3 pitfalls that you should be aware of:

- Reverse mortgages have much higher interest than traditional lending institutions. For example, if rates are 3.69% for a 5 year fixed rate, a reverse mortgage would easily be in the mid 5% range.

- This is a big one! The interest is compounded for as long as you own the home or you die. You are not making any principal payments so interest costs balloon very quickly. It is called “negative amortization” and you may end up with a lot less than you expected – either for yourself, if you are moving into a long term care facility, or for your estate.

- If you did decide to pay out the mortgage before the term has been completed, there are very stiff penalties.

Remember that there are other cost effective mortgage strategies (financial planners agree!) to explore before taking out a reverse mortgage. Ask me about them!

Renewing Your Mortgage?

Refinancing has become a lot more complicated!

Interesting factoid. Around 47% of all existing mortgages will need to be refinanced this year, according to CIBC estimates. This is up from 25 to 35 percent in a typical year. It attributes the increase to unintended consequences of regulatory changes in recent years, such as stress testing rules and rising interest rates. Before you even think about renewing talk to your financial planner. Develop an up to date overview of your income and expenses and discuss what’s changed since you obtained your existing mortgage. Then work with a Mortgage Broker, like Tracy Irwin, who will help you find the right mortgage financing product for your needs. Mortgage Brokers have access to thousands of products from hundreds of lenders – and best of all – it doesn’t cost you a thing. Mortgage Broker fees are paid by lenders not homeowners. Talk to Tracy today!

Tracy Irwin: Community Volunteer

Tracy Irwin: Community Volunteer

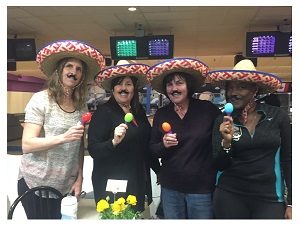

Tracy organized the 1st Annual Bowl-a-Thon in support of the Suicide Prevention Community Council of Hamilton. Get this, the event raised over $8,000 – despite the fact that it was held on Saturday, April 14, the day of the freak freezing-rain storm! The money raised will be used to create postvention* strategies for our community. There was a prize for the best dressed team – The 5 Amigos (with one missing)!

*postvention definition: A postvention is an intervention conducted after a suicide, largely taking the form of support for the bereaved (family, friends, professionals and peers).