The moment you start thinking about buying a home is the moment to start thinking about where your down-payment will come from.

The moment you start thinking about buying a home is the moment to start thinking about where your down-payment will come from.

Moving all your sources of money for a down-payment into a single “staging” bank account will help. This may take a while, and yes, you’ll lose out on the (puny amount of) interest offered by financial institutions, but in the end, it will simplify and streamline the mortgage approval process AND reduce the paperwork you’ll be required to present. What mortgage approval process? What paperwork?

Mortgage Stuff You Probably Didn’t Know…

You probably don’t buy a new home every year, so don’t be too hard on yourself. Besides, just when you think you’ve got everything figured out, something changes, like down-payment requirements, mortgage stress tests, federal and provincial programs, etc. Ask a Mortgage Broker like me for help.

Why Do Lenders Care About Down-Payment Sources?

Mortgage lenders need to be sure the down-payment is from legitimate sources. Here are four things they are watching for:

- Anti Money Laundering (AML). Lenders care about deposits over $10,000 and where they originated.

- Sanctioned Countries. Lenders also care about whether the down-payment originated from a sanctioned country.

- Tax Avoidance. Lenders want to make sure the cash is from legitimate sources and not ‘under the table.’

- Borrowed Money. This often catches borrowers by surprise: The lender wants to know if any part of the down payment or closing costs is borrowed. Repayments change a borrower’s debt service ratios.

Sometimes clients feel this verification process is an invasion of their privacy. I understand. It is the lender’s right however, to ask for all the information they believe is reasonable. Most lenders request a 90-day history, but some will go back further to satisfy themselves that the source of funds is legitimate. Have a mortgage question? Answers await!

Four Typical Down-Payment Sources

- Personal Savings such as saving and chequing accounts, mutual funds, GICs, RRSPs, TFSAs and stock trading accounts.

- Gifted funds. Sometimes known as the “Bank of Mom & Dad”. Gifted funds are fine. Family loans, however, are not. They are treated as “borrowed money” (see #4 above).

- Self-employed. Some applicants rely on money from their business.

- Overseas Bank Accounts. Or generous family members overseas who wish to help out with gifts (not loans).

Buying a home should be an exciting and rewarding experience. I can help you and your family navigate the mortgage process and move into the home of your dreams. Hop over to my blog for lots more mortgage information and get in touch with me, Tracy Irwin, Mortgage Broker any time.

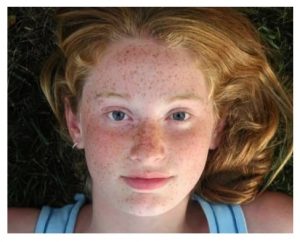

Running For Rachael 2021

Join us in supporting city-wide suicide prevention with this year’s Running For Rachael on Sunday, September 26th. Register today!

Join us in supporting city-wide suicide prevention with this year’s Running For Rachael on Sunday, September 26th. Register today!

Choose to walk/run with your household, or your team (while maintaining local social distancing rules and public health protocols). Meet Rachael. Learn more. Save a life.