Follow the Leader…

Starting June 1, both insured and uninsured mortgage borrowers are subject to a stricter stress test when qualifying for their mortgage. The Office of the Superintendent of Financial Institutions (OSFI) confirmed that it has moved ahead with its stress test changes which apply to uninsured mortgages (typically those with more than a 20% down payment).

Starting June 1, both insured and uninsured mortgage borrowers are subject to a stricter stress test when qualifying for their mortgage. The Office of the Superintendent of Financial Institutions (OSFI) confirmed that it has moved ahead with its stress test changes which apply to uninsured mortgages (typically those with more than a 20% down payment).

Soon after, the Department of Finance confirmed it is following OSFI’s lead, and applying the same higher qualifying rate to insured mortgages, or those with less than 20% down. In both cases, borrowers will need to prove they can afford payments based on the higher of the contract rate plus 2%, or a new base rate of 5.25%, up from the current 4.79%. Read the article…

Who is Impacted?

Applying the modified stress test to insured borrowers will impact roughly 1 in 5 mortgage borrowers, according to data from the Bank of Canada. It also takes direct aim at first-time borrowers who are more likely to be putting less than 20% down on a mortgage. Need help navigating the mortgage process? I’m a here for you as an advisor and trusted Mortgage Broker. Let’s talk today.

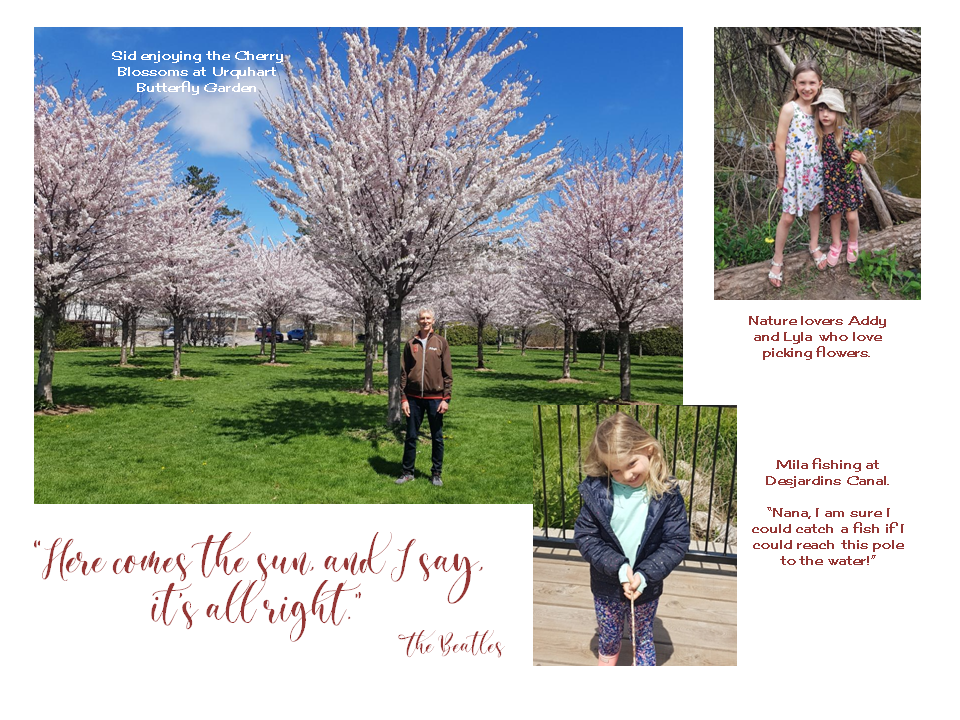

Ahhh… the Great Outdoors!