The Pros and Cons of Lump Sum Mortgage Payments

2025-06-24 | 09:22:16

Ever wondered what you’d do if you found yourself with a bit of extra money? Don’t we all? Perhaps you’re in line for a bonus at work, or you’ve received a tax refund, gift, insurance, or legal settlement. We can’t forget winning the lottery, can we? You’re going to have lots of options to consider, including topping up your emergency fund, investments (RRSP, RESP, and TFSA contributions), paying off high-interest debt (i.e., credit cards), and this one… making a lump sum mortgage payment.

Pros to Making a Lump Sum Payment on your Mortgage

• Reduce interest payments

• Build equity faster

• Pay off the mortgage loan sooner

Cons to Making a Lump Sum Payment on your Mortgage

• Possible prepayment penalties

• Missing out on better investment returns

• Loss of liquidity

What it all means

The decision to make a lump sum mortgage payment shouldn’t be made in isolation. Paying down your mortgage loan and becoming debt-free sooner feels great, but you don’t necessarily want to do it at the expense of flexibility. Review all of your debts, talk to your accountant, talk to your mortgage broker (that’s me). Your team is here to support you and your overall financial plan.

In essence, have a plan!

Is 300 Your Lucky Number?

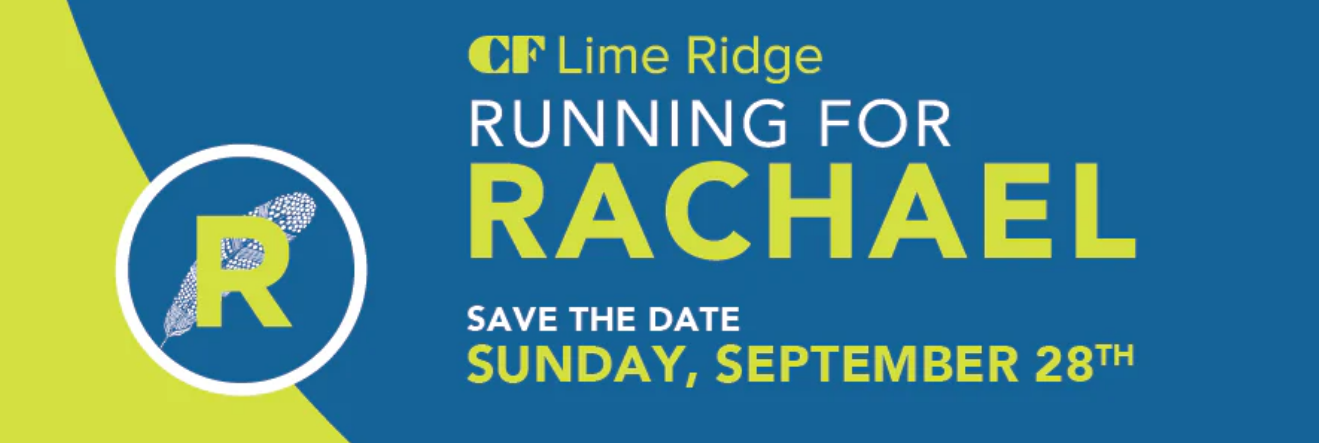

It’s ours! 300 is the number of participants we’re hoping for at this year’s Running For Rachael event on Sunday, September 28. We know – there are a lot of things to do on Sundays. But this Sunday in particular is one where we are inviting our community to come together, stand up, and support suicide prevention. https://www.runningforrachael.com/

Running For Rachael is a 5K Walk/Run that starts at 8:00 am at CF Lime Ridge Mall in Hamilton at 999 Upper Wentworth Street. You’ll feel the energy of amazing people who, like us, believe in one race, one mission, one incredible community. Early bird pricing is in effect until June 30th. Let’s go!

Proudly Canadian!

Meet our Family of Professional Posers!

We're getting great at posing for photos! See what I mean?