The new Liberal government says, “We will make it easier for Canadians to find an affordable place to call home.” Today, one in four Canadian households is paying more than it can afford for housing, and one in eight cannot find affordable housing that is safe, suitable, and well maintained. When affordable housing is in short supply, Canadians feel less secure and our whole economy suffers. Read more about affordable housing here: https://www.liberal.ca/realchange/affordable-housing/.

The new Liberal government says, “We will make it easier for Canadians to find an affordable place to call home.” Today, one in four Canadian households is paying more than it can afford for housing, and one in eight cannot find affordable housing that is safe, suitable, and well maintained. When affordable housing is in short supply, Canadians feel less secure and our whole economy suffers. Read more about affordable housing here: https://www.liberal.ca/realchange/affordable-housing/.

Canadian Mortgage Trends published an article last month entitled, The Liberal Effect. It details what the mortgage market can expect from Mr. Trudeau’s new government related to mortgage policy, interest rates and affordable housing initiatives. Read on.

1. “Higher bond yields: Balancing the budget is not a priority for the Liberals until 2019. Trudeau is expected to go on a spending spree and bond traders aren’t keen about it. It suggests a greater supply of government debt and potentially higher long-term yields to come. That, of course, could mean at least slightly higher fixed mortgage rates than we’d otherwise see.

2. A More Hawkish Poloz: The odds just dropped for a cut in prime rate. More spending by Ottawa puts less pressure on governor Stephen Poloz to stimulate the economy with rate cuts. The implied probability of a rate hike by next October has almost doubled, from 8% yesterday to 15% as we speak.

3. Wider RRSP Access: The Liberals say they’ll open access to the RRSP Home Buyer’s Plan, particularly for homebuyers coping with significant life changes (divorce, death of a spouse, a sick or elderly family member, etc.). More access to down payment funds will prop up housing sales and home ownership slightly, and support home prices.

4. More “Affordability”: The Liberal platform includes a review of housing policy in high-priced markets. The new government will “consider all policy tools that could keep home ownership within reach.” What that means, we’ll have to wait and see. It could definitely be positive for renters and income property investors, given the Liberals have promised to “direct CMHC…to provide financing to support the construction” of new rental housing.

5. First-timer Support: Trudeau’s government will add more flexible programs for first-time homebuyers. This could mean any number of things, potentially even higher amortization limits for new buyers.

6. New Blood at the DoF: The Liberals will be installing a new Minister of Finance, who has enormous power over housing regulation. Will he or she be as hands-off on mortgage policy as the outgoing Joe Oliver? We’re guessing not. We’ll likely have an answer by the time the Liberals release their first budget next spring.”

Navigate the complex world of homeownership, mortgage financing for first, second or fifth time with a professional mortgage broker who cares. Contact Tracy Irwin today.

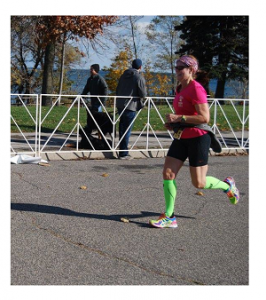

Tracy’s Latest Running Adventure

The Hamilton Marathon – Road 2 Hope – Sunday, November 1st

The Hamilton Marathon – Road 2 Hope – Sunday, November 1st

It’s the fastest qualifying race in North America for Boston. Tracy ran the 21k distance and was sure glad to be finished her windy adventure! The scenery running down the Red Hill Creek expressway and along the beach front at Confederation Park was stunning! The race raised over $30,000 for local charity, City Kidz, and international charity, Joy and Hope in Haiti.