Happy New Year. May 2023 be your year to shine!

We all know, forecasts are one thing, but reality can be quite another, especially when it comes to the weather!

Today, I’m featuring an excerpt from a Canadian Mortgage Trends article detailing housing and interest rate forecasts from all the major players.

What does 2023 hold in store for you?

If you’re thinking of making a change (re-financing or moving), let’s chat!

2023 Housing and Interest Rate Forecasts

“Rising interest rates in 2022 drove home sales and prices lower, though price declines have so far been somewhat modest compared to the run-up in prices in recent years.

But what does 2023 hold in store? Below, we’ve compiled an assortment of forecasts, with some predictions for relatively flat-lined growth, while others see further declines on the horizon.

Looking at 2022, projected figures suggest home sales will end the year at 532,545, a 20% decline compared to 2021, according to the Canadian Real Estate Association (CREA). Home prices, meanwhile, are forecast to end the year up 4.7% to an annual average of $720,255.

Tight supply has been a recurring theme, with CREA noting the months of inventory measure remains historically low, despite improvements in recent months.

“In terms of monthly new supply, the bigger picture is listings are not flooding the market,” CREA noted. With the exception of 2019, November 2022 saw the fewest new listings for that month in 17 years.

While home price growth is expected to moderate in 2023, recent data show Canadians continue to hold a positive view towards real estate.

“Canadians are understandably hesitant to engage in the market early in 2023,” said Re/Max Canada President Christopher Alexander. “Despite this, more Canadians see real estate as a solid long-term investment when compared to this time last year.”

Real Estate Market

CREA

- 2023 home sales forecast: 520,156 (-2.3% year-over-year)

- 2023 home price forecast: $721,814 (+0.2%)

- Commentary: “With interest rates on the rise, home sales have continued to cool. In some parts of the country, home prices have fallen from their peaks reached earlier this year, are flat in some regions, and are still climbing in others. The issue of not enough homes for sale has not gone away.”

- Link

Interest Rate and Bond Yield Forecasts

The following are the latest interest rate and bond yield forecasts from the Big 6 banks, with any changes from their previous forecasts in parenthesis.

Averaging the forecasts, the Big 6 banks expect that the overnight rate has peaked at 4.25%, with the potential for one more quarter-point hike in early 2023.

Looking ahead to the end of 2023 and into 2024, analysts are pencilling in the first Bank of Canada rate cuts, which could take the overnight rate back down to the 3.00% mark by the end of 2024.”

|

Target Rate:

Year-end ’23 |

Target Rate:

Year-end ’24 |

Target Rate:

Year-end ’25 |

5-Year BoC Bond Yield:

Year-end ’22 |

5-Year BoC Bond Yield:

Year-end ’23 |

| BMO |

4.50% |

NA |

NA |

3.00% (-85bps) |

3.25% (-20bps) |

| CIBC |

4.25% |

4.25% |

NA |

NA |

NA |

| NBC |

3.75% (-50bps) |

3.00% (-75bps) |

NA |

3.00% (-40bps) |

2.65% (-50bps) |

| RBC |

4.25% (+25bps) |

3.00% (-100bps) |

NA |

3.15% (-30bps) |

2.75% (-20bps) |

| Scotia |

4.25% (-25bps) |

4.00% |

3.00% |

3.90% |

3.55% |

| TD |

3.75% (-50bps) |

2.25% (-100bps) |

NA |

3.10% (-60bps) |

2.60% (+5bps) |

Mortgage news you can use

I’m here to help! If you, or someone you know, wants to learn more about mortgage financing, including how Canada Mortgage and Housing Corporation (CMHC) rules affect mortgage applicants, get in touch today.

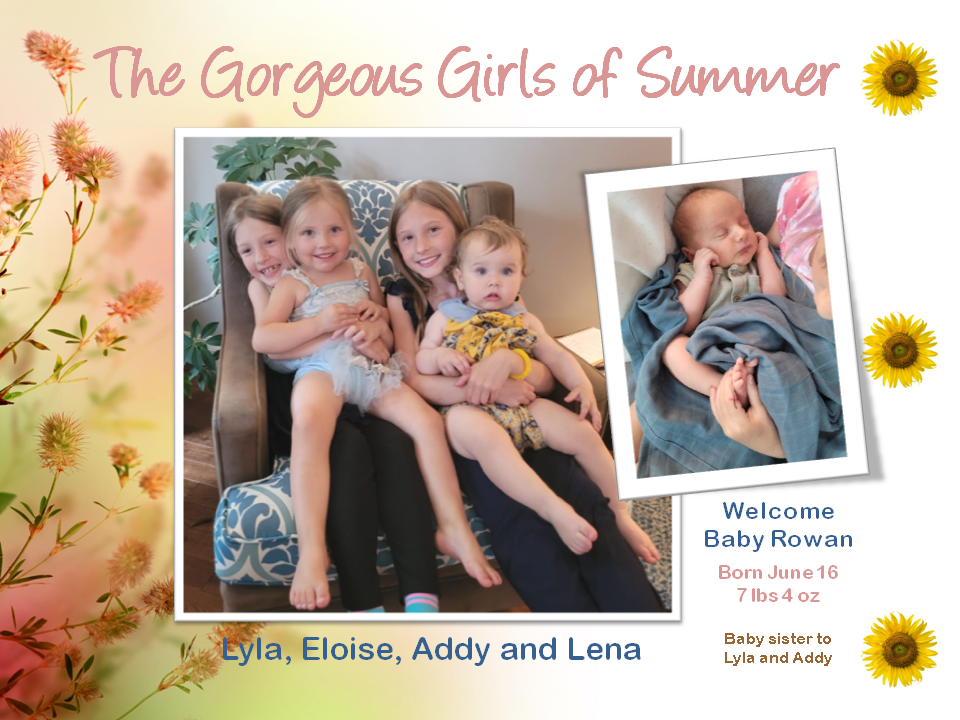

Our Early Christmas Gift

Welcome Kali Blake Irwin to our growing family. Born on December 16th at 7 lbs 6 ozs. Big sisters Mila and Sloane are very excited (but did wonder if the baby could stay at the hospital and Mommy come home). We are delighted to welcome our 9th grandchild to our beautiful family.

Welcome Kali Blake Irwin to our growing family. Born on December 16th at 7 lbs 6 ozs. Big sisters Mila and Sloane are very excited (but did wonder if the baby could stay at the hospital and Mommy come home). We are delighted to welcome our 9th grandchild to our beautiful family.

“Fasten your seat belts, it’s going to be a bumpy night” were the immortal words of Bette Davis in the 1950 classic movie, All About Eve. Know what else can be bumpy? Mortgage renewals. But they don’t have to be.

“Fasten your seat belts, it’s going to be a bumpy night” were the immortal words of Bette Davis in the 1950 classic movie, All About Eve. Know what else can be bumpy? Mortgage renewals. But they don’t have to be.

Welcome Kali Blake Irwin to our growing family. Born on December 16th at 7 lbs 6 ozs. Big sisters Mila and Sloane are very excited (but did wonder if the baby could stay at the hospital and Mommy come home). We are delighted to welcome our 9th grandchild to our beautiful family.

Welcome Kali Blake Irwin to our growing family. Born on December 16th at 7 lbs 6 ozs. Big sisters Mila and Sloane are very excited (but did wonder if the baby could stay at the hospital and Mommy come home). We are delighted to welcome our 9th grandchild to our beautiful family.

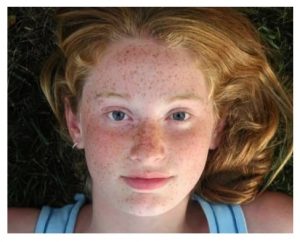

The 10th Anniversary of Running For Rachael raised an amazing $35,563.98.

The 10th Anniversary of Running For Rachael raised an amazing $35,563.98.

Fresh air and exercise help clear your lungs, lower your blood pressure, give you more energy and better mental focus!

Fresh air and exercise help clear your lungs, lower your blood pressure, give you more energy and better mental focus!