When the Office of the Superintendent of Financial Institutions (OSFI) increased capital requirements on default insurers – and linked its capital formula to credit scores* – many securitizing lenders have opted to do two things:

When the Office of the Superintendent of Financial Institutions (OSFI) increased capital requirements on default insurers – and linked its capital formula to credit scores* – many securitizing lenders have opted to do two things:

Thing One: set different rates for different credit score ranges – and / or

Thing Two: raise their minimum credit scores for mortgage products

*A credit score is a tool used by credit grantors to determine your ability to repay your debts. The information on your credit report is compared and evaluated against other consumer credit reports which gives you a credit score ranging from 350 (highest credit risk) up to 800 (lowest credit risk). A higher score means you are less likely to make late payments or default on the credit extended to you.

For some lenders, borrowers with, for example, a 640 credit score, are offered rates that are 1/4 point higher than someone with a 760 score. On conventional mortgages, the magic number seems to be 720, according to mortgage columnist, Robert McLister. On scores below that, lenders’ extra insurance costs start climbing and some of them pass that on to borrowers.

New Credit Score Lending Trend Requires Client Education

More than half (56%) of credit card holders admit they don’t understand how their credit

score is calculated. Forty percent don’t grasp the importance of making more than their

minimum monthly payments. Cardholders who pay more than the required minimum each month are less risky borrowers in general, something that is reflected in their credit scores.

How Your Credit Score is Calculated

The guidelines used in determining your score include:

- payment history – paying your bills on time is the single most important factor in

obtaining a high credit score. - how much debt you carry– keep your credit cards low to keep a high credit score.

Your outstanding balance should be less than 65% of your credit limit. - length of established credit – the longer you have had the credit cards, the higher

your score. - applications for new credit – a high number of credit inquiries will lower your

score. - your credit mix – open only credit accounts that you intend to use on a regular

basis.

Knowing how your credit score is determined can help you manage your debts to optimize your rating. Do you know your credit score? Do you know how to get your credit score? Want to learn more about how your credit score affects your borrowing potential? Talk to Tracy Irwin today!

Family Fun

Oh it’s been a busy few weeks with family and friends.

Oh it’s been a busy few weeks with family and friends.

Check out these keepers.

(Only a devoted grandmother, like Tracy would touch a tarantula on purpose!)

Hamilton’s Winter Wonderland

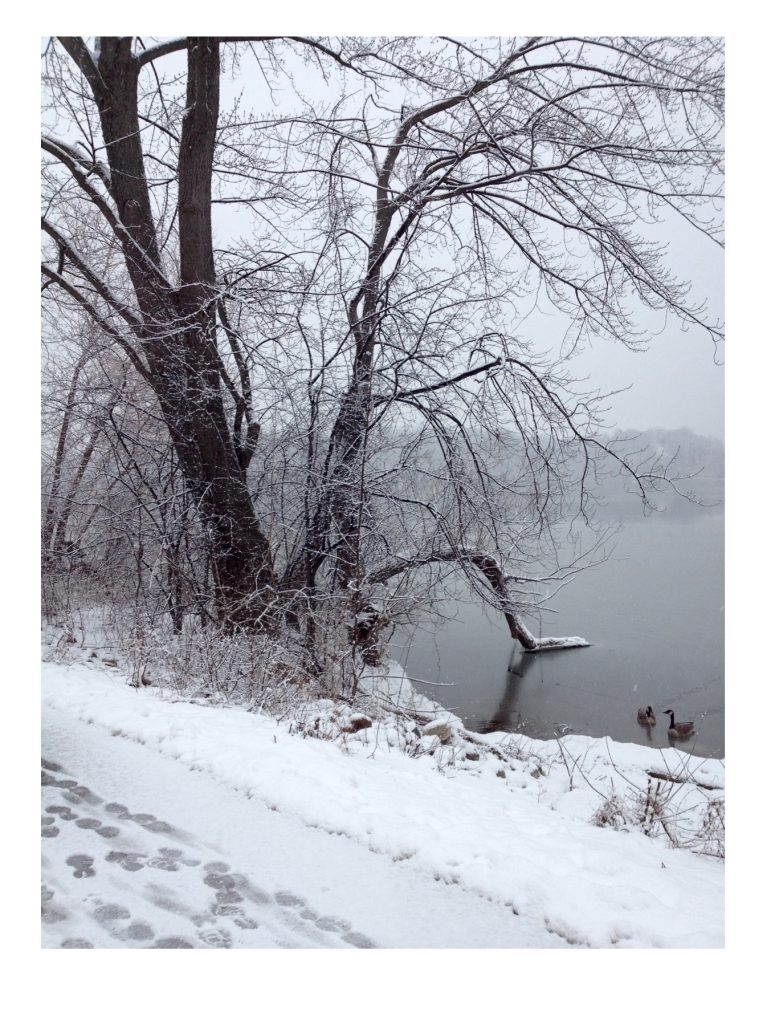

Tracy snapped this stunning photo during an informal 10K run down at the Hamilton Waterfront Trail near Cootes Paradise. (How’d she get the geese to pose so nicely?)

Tracy snapped this stunning photo during an informal 10K run down at the Hamilton Waterfront Trail near Cootes Paradise. (How’d she get the geese to pose so nicely?)